Fha construction loan calculator

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. If you would like to use an FHA 203k loan and youre 203k eligible its best to work with a lender who has experience with them.

Home Construction Loan Calculator Estimate Monthly Io Amortizing Payments Using Current Rates

FHA Fixed Rate FHA ARM.

. We have done extensive research on the FHA Federal Housing Administration and the VA Department of Veterans Affairs One-Time Close Construction loan programs. You can get one with a down payment as low as 35. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

The bank has grown its services to lend in all 50 states and originates over 1 billion. Because this type of loan. Since the year 2000 FHA loan rates were usually 0125 to 025 higher than conventional loans.

HUD 40001 page 135. Is a 203k loan worth it. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

What is the purpose of this program. Construction loans that include an interest reserve account not only help your cash flow as you are not saddled with two house payments but also allow you to qualify for a larger loan amount since present and future housing expenses are not included in your debt ratio. Purchase or refinance your home with an FHA loan.

FHA construction loan versus FHA 203k loan Its easy to confuse an FHA construction-to-permanent loan with another type of FHA product. To provide mortgage insurance for a person to purchase or refinance a principal residence. An FHA construction loan will have a few more stipulations as well such as land ownership involved in the deal.

FHA loan rules require the loan officer to verify all income that will be used toward calculating the borrowers debt-to-income ratio. Occupancy is required for both new purchase and FHA cash-out refinance loans. A 203k loan can be well worth the extra effort especially if you can buy a home at a discount.

For a borrower putting down 3 on a conventional loan comparable to the 35 minimum down payment on an FHA loan the APR would look a lot closer to the APR for an FHA mortgage. Using a mortgage calculator you can estimate. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. But except for the years following the late 2000s financial crisis 2010 2015 for a couple of years FHA loan rates were lower than conventional mortgages. FHA loan requirements and guidelines for mortgage insurance lending limits debt to income ratios credit issues and closing costs.

If you owned the land for more than six months you cannot qualify for this loan. But these are very different. In the following example a borrower obtained an FHA loan of 275000 to purchase a home.

A basic and simple to use Construction Loan Amount Calculator is available here. Whether an FHA loan will be more expensive than a conventional loan depends on the total mortgage amount as well as the size of your down payment. An FHA loan is a mortgage insured by the Federal Housing Administration.

The FHA loan applicant who cannot show at least one year of on-time payments to all creditors in the time leading up to the new loan application may find it difficult to get an FHA loan approved. An FHA construction loan combines the advantages of a traditional FHA loan with the benefits of a short-term construction loan. The FHAHUD official site has a section that explains the hows and whys of the FHA 203b loan.

Verifiable income can be used which means the lender must determine that the income is stable reliable and likely to continue. This is what the FHA loan rulebook HUD 41551 says about a lack of credit history as described above. As of today the value has increased to 350000 with a balance of 250000 owed on the mortgage.

FHA lenders are limited to charging no more than 3 to 5 percent of the loan amount in closing costs and the FHA allows up to 6 percent of the borrowers closing costs such as fees for an. According to the FHA official site a set of rule changes that were issued in past years intended to streamline requirements for. Back in 2020 the FHA and HUD announced changes to the FHA loan rules for new construction loans which are used to build a home rather than having the borrower buy an existing property previously occupied by the former owner.

FHA loans have lower credit and down payment requirements for qualified homebuyers. Use this FHA mortgage calculator to get an estimate. Streamline Refinance Cash-out Refinance Simple.

For instance a buyer pays 200000 for a run-down home but does 20000. Your city will also need to provide a certificate of occupancy following a detailed inspection of the property after the building period. Mortgage loan basics Basic concepts and legal regulation.

Lenders with significant 203k loan experience can also. 60 days after. FHA loan rules in HUD 40001 say that FHA mortgages can never be used for vacation properties timeshares or transient occupancy.

The 203b loan mentioned in the question on the other hand is essentially the FHA standard single family home loan. The FHA 203k rehab loan. Construction Loan Buyer Benefits Builder Benefits Build on Your Land.

We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. Allowing down payments as low as 35 with a 580 FICO FHA loans are helpful for buyers with limited savings or lower. Construction Loan Buyer Benefits Builder Benefits Build on Your Land.

Browse through our frequent homebuyer questions to learn the ins and outs of this. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford.

For instance the minimum required down payment for an FHA loan is only 35 of the purchase price. How FHA loans work. FHA mortgage insurance protects lenders against losses.

Nationwide Home Loans Group is a division of Magnolia Bank an independent community bank founded in 1919. He makes his monthly payments as agreed.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

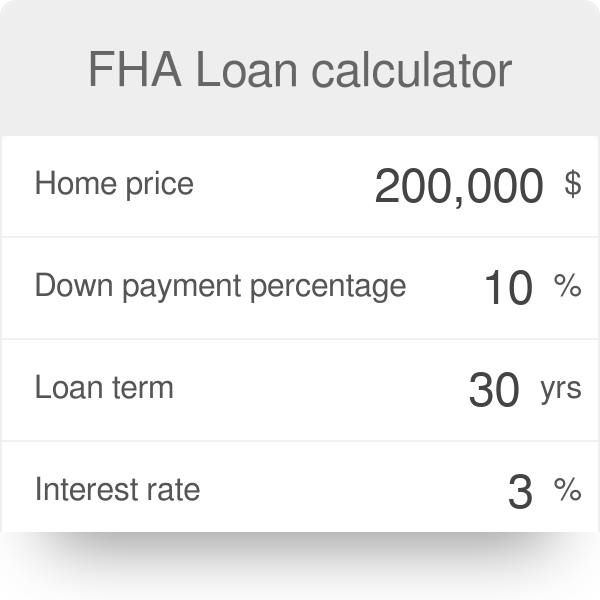

Fha Loan Calculator For First Time Home Buyers

Fha Loan Calculators

Fha Loan Calculators

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator

T1qtzmzpoweigm

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Fha Loan Calculator For First Time Home Buyers

Fha One Time Close Construction Loans In 2022

Home Construction Loan Calculator Estimate Monthly Io Amortizing Payments Using Current Rates

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha New Construction Loan Requirements Guidelines Property Types

Minimum Credit Scores For Fha Loans

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Calculator For First Time Home Buyers

Fha One Time Close Construction Loans For 2020